This year wasn’t easy for any industry, and the banking sector is not an exception. The leaders of the industry weighed in on post-Covid recovery efforts aimed to save banks from bankruptcy and keep their clients financially secured. One of the main purposes of CRM is to retain existing clients and ease onboarding of the new ones. Banks need their customers to stay alive and it’s the reason why CRM and banking can’t exist without one another. In this article, we’ll uncover the key challenges every player in the banking industry meets when it comes to adopting CRM solutions and what benefits can be delivered.

What is a CRM in the Banking Industry?

In the banking industry, one of the biggest business challenges is understanding customers’ demands and meeting clients’ expectations. Banks should not only focus on providing valuable services to the customers, but also focusing on maintaining a long and good relationship with their clients.

CRM in the banking sector allows banking organizations to build a customer-focused business framework to understand the customer’s needs and demands and, more importantly, meet them with your banking and financial services.

Just like any organization’s success, high customer satisfaction and retention are critical for a bank’s success in today’s competitive market scenario. According to a study by Reichheld and Sasser, banking businesses can observe an improvement in the profit margins by up to 35%, just from the 5% growth in customer retention rate.

Unlike personal banking, it’s more difficult for business bankers to offer current account services or business lending. You require more in-depth knowledge of the client’s business, niche, market situation, and tailor-made solutions to offer good financial advice and onboard a business client.

This is why CRM has become more crucial than ever before in the highly competitive banking industry, where you need a customer-centric approach to manage customers, understand their expectations and offer personalized solutions and win more clients and retain them.

Challenges of CRM in the Banking Industry

Just like any other business, banks face several challenges when looking to adopt CRM software.

Data security

The banking industry is very sensitive to data security and aims to deliver an extra level of control over access to their records. Besides their clients’ personal information and account records, the entire banking system should be well protected against cyber-attacks and malicious software. Modern CRM platform providers are well aware of these concerns and provide excellent security measures, from role-based access permission to encrypted transactions and data backups, to ensure high level of information security.

Integration with the existing tech stack

Pretty much every financial and banking organization has a legacy IT infrastructure and tech stack that might be complicated to interfere with. Most of the outdated software wasn’t built to work together with the modern CRM systems. It means that any bank can face the problem of integrating new solutions with the existing ones without any data loss and system failures. The good news is CRM specialists such as OMI can help you seamlessly integrate a CRM system of your choice into your company’s infrastructure and make sure the new solution works perfectly.

So when does the banking industry need to consider CRM adoption? The answer is pretty simple – ASAP, because lack of data visibility provided by CRM can cost your organization loses in clients and profits. Moreover, lack of customer-related information doesn’t allow you to thoroughly analyze your customers’ behavior and provide them with the quality of services they seek.

Benefits of CRM in the Banking Sector

Both customers and banking organizations can benefit from using CRM. The first ones get more personalized high-quality services, while the second ones get better control of their operations and can deliver this type of service. Here are the main benefits the banking sector can gain from using CRM systems:

Get and qualify more leads

CRM system helps you to reach out to your leads as quickly as possible to either help them with their challenges or understand that your service is not what they are looking for. As a result, the lead qualification process is sped up and your sales department can focus on converting leads into actual sales.

Build strong relationships with clients

Launch marketing campaigns, streamline communication, and provide a personalized approach to increase your customers’ satisfaction rates and make them get what they need and when they need it. Your clients will appreciate your care and attention.

Improve staff’s productivity

CRMs help to streamline processes across various departments, as well as to eliminate repetitive tasks and let your staff focus more on clients and improve their performance.

Get valuable insights

The system analyzes data on your customers’ behavior such as chosen types of credit and debit cards, number of transactions, type of transactions, etc. This data can be later used by your sales and marketing departments to improve your services.

Drive new business opportunities

Every industry needs to keep up with the constantly changing economy and market demands. Analyzed customers’ data can be used to introduce new solutions to fulfill your clients’ needs. As a result, your business credibility, loyalty, and awareness increase letting potential customers know that they can trust your organization.

CRM Solutions for Banks

OMI provides one of the best CRM services for banks and financial institutions and offers customizable solutions to make sure their functionality perfectly aligns with your organization’s needs.

Salesforce for Banks

Salesforce is one of the best CRM software for the banking industry and offers a great number of tools and services that can be used across banking organizations for process management and team collaboration.

Salesforce allows banks to gain a complete view of each client by unifying all your banking operations – in-branch as well as digital channels. Third-party integrations give you endless possibilities to build sophisticated tasks management systems for sales, marketing, and customer service that can help your bank to increase process efficiency.

Process automation in the banking sector is essential to eliminate many tedious tasks that are essential to reduce operations costs and improve work efficiency and gain more clients faster. Salesforce comes with a Marketing Cloud module, that allows you to manage everything from marketing intelligence to customer retention, and community engagement, for a centralized platform.

Salesforce consultants at OMI help you evaluate your business state and challenges and pick the right CRM configuration.

Microsoft Dynamics 365 for Banks

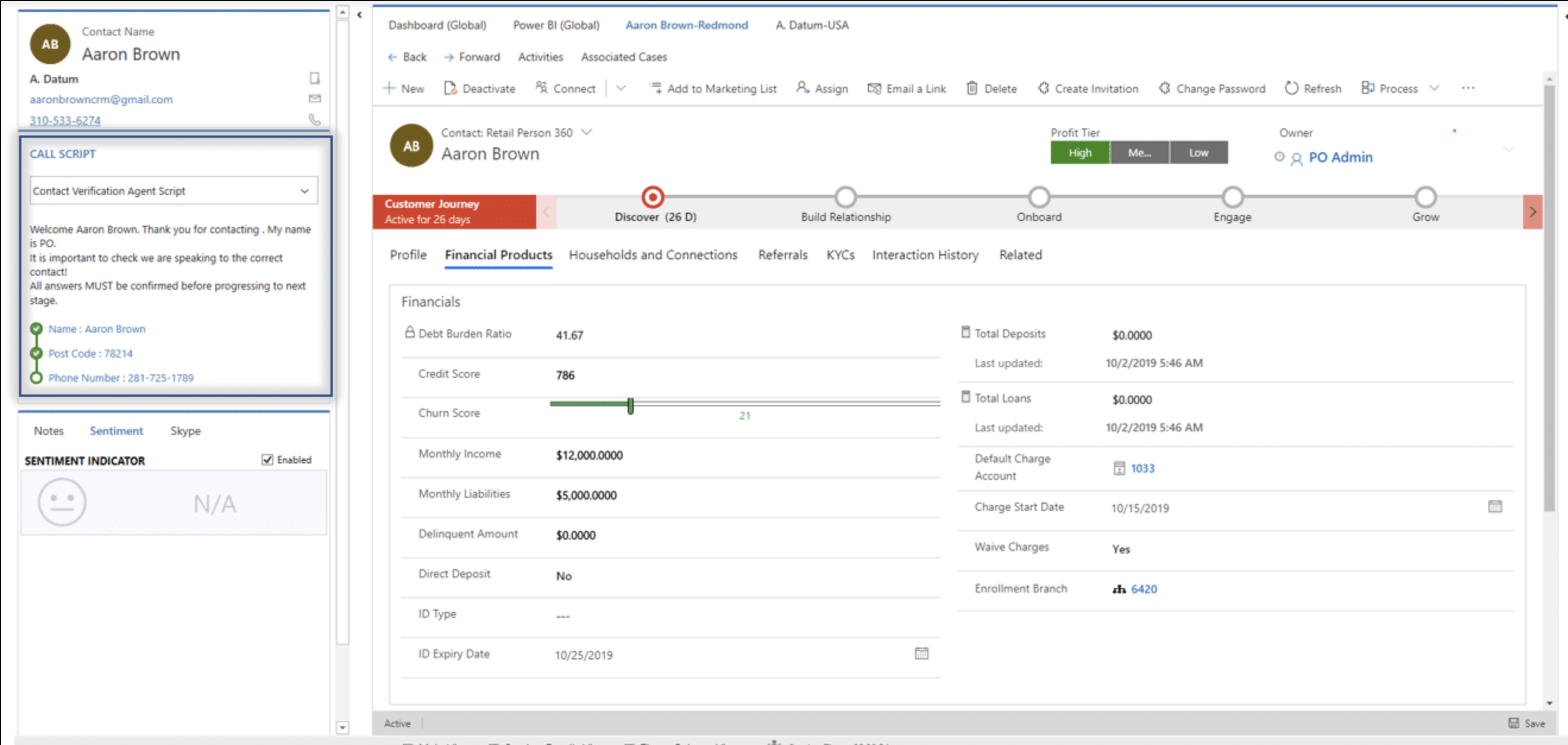

Microsoft Dynamics 365 is another great CRM solution that features a variety of tools for all kinds of business needs, from internal process management to customer engagement.

Microsoft Dynamics 365 along with the “Banking Accelerator” feature, allows banks to quickly develop intelligent financial services and innovative solutions powered by industry-standard data models. This data-driven “Banking Accelerator” helps banks to offer an improved banking experience – that helps them to stand out from their competitors and boost customer acquisition, loyalty and retention.

Communication process automation and customer insights help banks to offer customized deals and personalized experiences for financial services. Positive customer experiences directly impact long-term customer relationships that result in higher retention rates and accelerate business growth.

OMI can help your organization to implement MS Dynamics and power up your teams with full-feature tools to help your company grow. Make sure to reach out to one of your specialists and we’ll be glad to discuss your project in more detail.